Direct Debit Timings - And Why They Can Take So Long!

The first thing to know about direct debit (bank) payments is that they are not instant.

AS OF NOVEMBER 2024 - *Pinch now offers T+2 settlement times, which means funds clear to your chosen account on average two days faster than previously*

You may be familiar with Osko which allows you to transfer money to friends or family, instantly. Unfortunately this is all one way, push traffic - pushing your funds to another person's bank account. Australia, as of writing this, has no instant pull traffic - for example, your friend requesting to debit your account for half of the dinner bill.

PayTo hopes to build on the success of Osko payments to allow for faster, pull based payments but let's first explain what happens when you take a direct debit payment and the timings surrounding this.

Direct debit payments in Australia are processed via the Bulk Electronic Clearing System.

BECS is a reusable, delayed notification payment method.

The reusable part is that once your customer has given approval for the direct debit to take place (e.g. a Direct Debit Request form) you do not have to get this form filled out for each future payment.

The delayed notification means that your customer's bank can take up to 3 business days to return a response that indicates whether the debit worked or not. In addition to the 3 business days, banks have a hard cut off time of 16:00 AEDT and no payments are made on weekends or public holidays.

The BECS system does not apply to credit cards which are instead run by the schemes (e.g. Visa or Mastercard). These schemes are able to provide instant responses on whether the funds are available for deduction.

This delayed notification is frustrating but one that has existed for longer than Pinch and we have no control over this. The best we can do is that once Pinch receives confirmation that the direct debit was successful, we are paid out the funds and then organise for settlement to your business bank account the next day.

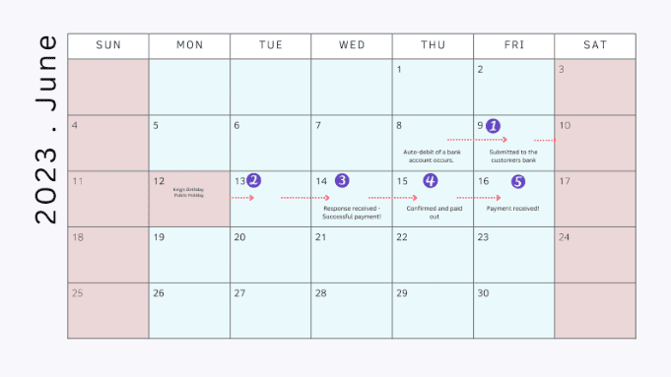

To illustrate this timeline, we can look forward to June 2023. Your direct debit request can be initiated on a Thursday and thanks to the weekend and public holiday, not be paid out into your business bank account until the following Friday.

During this time, you can see the status of your Payment as ‘Processing”. This status will remain until either the payment is successful or failed.

If a customer's bank details are incorrect, you will be notified the next day of failed payment due to this - the only instant notification we have.

So when will direct debit payments be faster?

PayTo is expected to be rolled out across banks in mid-2023.

Essentially, PayTo works like an instant Direct Debit Request. Rather than asking customers to store their bank details with Pinch, customers can directly see the agreement via their bank account and agree there. This removes any concern that their bank details are being used incorrectly and gives more control to customers agreeing to direct debits.

Pinch will assist your business to have the agreement sent out to a customer and via PayTo they will agree and allow for instant debits when invoices are due - the dream!

PayTo is set to vastly improve the direct debit landscape - allowing both businesses to receive more instant payments and providing customers with more control over their bank accounts.

Pinch is excited to be on the forefront of PayTo but in the meantime, the BECS system is in place and we will notify you as soon as your payment is successful!